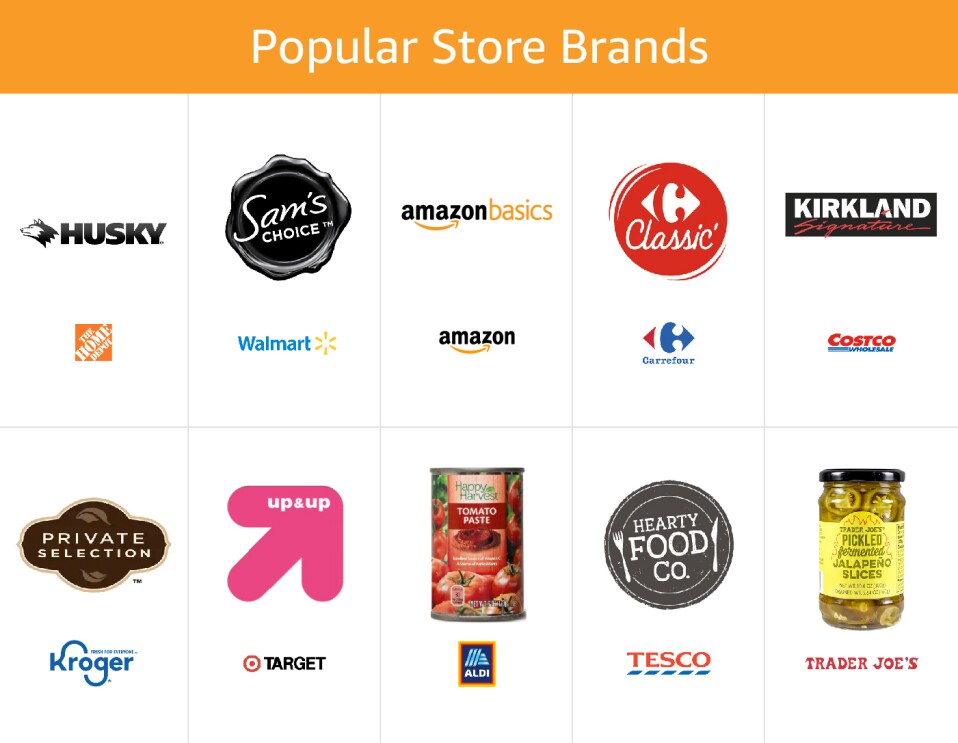

Is your home stocked with store brands? Perhaps you’re using Costco's Kirkland Signature olive oil or Aldi's Mamia baby wipes. Your garage may be stocked with Home Depot's Husky tools, or your closets with Walmart's George jeans. Maybe you use your pharmacy's generic version of ibuprofen. If you enjoy store brands, you’re not alone. When customers want more bang for their buck, they often turn to store brands known to offer high quality at prices that are generally lower than national brands. Retailers have been offering store brands for a long time—often jumping on the latest trends to provide lower cost alternatives even on the newest, most popular products.

Many customers choose where to shop on the strength of the store brand products available. In a recent survey, more than half of millennials say that their choice of store is influenced by its own brands. It’s not surprising then that store brand sales in the U.S. are growing faster than national brands. In Europe, too, the prominence and popularity of store brands continue to soar. Retail is fiercely competitive, and in many categories Amazon needs store brands to match the breadth of store brand selection available through other retailers and to provide timely, high quality options at a great value to our customers. That's why many of Amazon's most popular store brand products are the everyday staples you can expect to find in other stores too, like toilet paper, batteries, and t-shirts.

While popular with customers, store brands still make up a small portion of sales in our store and do not replace the incredible selection of products offered by our selling partners. By comparison, store brands from many large, national retailers make up anywhere from 15% to 90% of products sold in their stores. Customers like our store brands—on average, they have higher customer review ratings, lower return rates, and higher repeat purchase rates than other comparable brands in our store. This is why they keep our customers coming back to buy more from Amazon and independent sellers and why, like other retailers, we prominently feature store brand products in our store.

We’re excited to bring new options to our customers and will keep working hard to offer store brands where we believe Amazon store brands can provide great value and improve our selection of products.

Trending news and stories

- How Amazon proved its new delivery drone is safe for takeoff

- What is Amazon Pet Day? 48 hours of dedicated pet deals May 13-14

- What to know about grant applications for the Amazon Literary Partnership—and how to apply

- Amazon Pet Day 2025 is coming May 13-14 with 48 hours of deals on pet products and supplies